Click here for press release PDF

Click here for All Farm Price Index

Click here for Rural Market Report

Click here for Lifestyle Press Release

Data released today by the Real Estate Institute of New Zealand (REINZ) shows rural land buyers are taking a cautious approach to land purchases on the back of higher interest rates, government uncertainty and rising farm input costs.

There were 155 less farm sales (-33.7%) for the three months ended February 2023 than for the three months ended February 2022.

Overall, there were 305 farm sales in the three months ended February 2023, compared to 359 farm sales for the three months ended January 2023 (-15%), and 460 farm sales for the three months ended February 2022.

1,345 farms were sold in the year to February 2023, -457 less than were sold in the year to February 2022, with 28.9% less Dairy farms, 16.3% less Dairy Support, 16.3% less Grazing farms, 21.4% less Finishing farms and 40.9% less Arable farms sold over the same period.

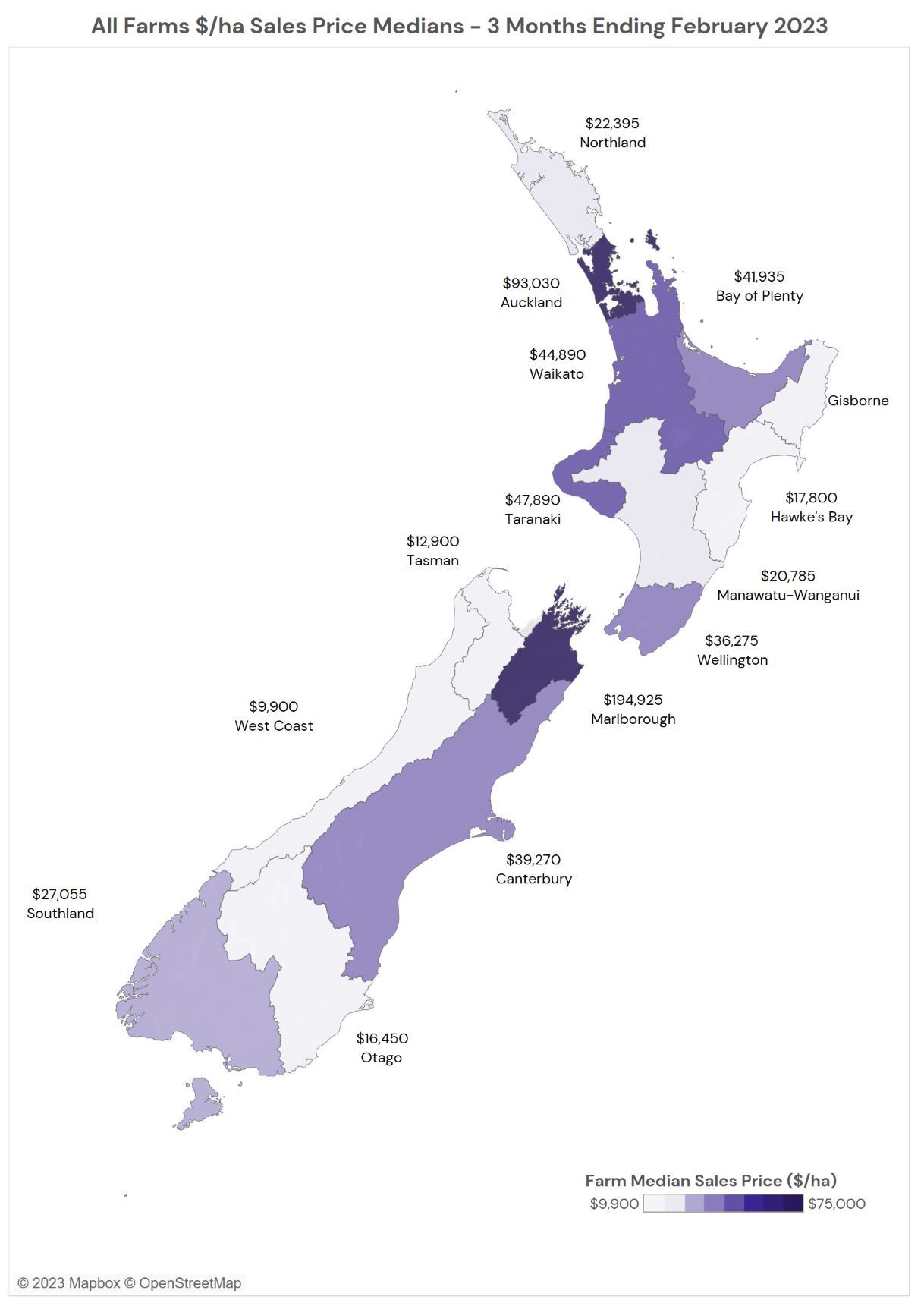

The median price per hectare for all farms sold in the three months to February 2023 was $31,830 compared to $29,990 recorded for three months ended February 2022 (+6.1%). The median price per hectare decreased 2.9% compared to January 2023.

The REINZ All Farm Price Index decreased 2.9% in the three months to February 2023 compared to the three months to January 2023. Compared to the three months ending February 2022 the REINZ All Farm Price Index decreased 2.5%. The REINZ All Farm Price Index adjusts for differences in farm size, location, and farming type, unlike the median price per hectare, which does not adjust for these factors.

One region recorded an increase in the number of farm sales for the three months ended February 2023 compared to the three months ended February 2022, with the most notable being Wellington (+5 sales) and Manawatu-Wanganui and Otago ( -5 sales). Northland ( -32 sales) and Taranaki ( -24 sales) recorded the biggest decreases in sales. Compared to the three months ended January 2023, two regions recorded an increase in sales, the most notable being Auckland and Wellington (+1 sale).

Shane O’Brien, Rural Spokesman, at REINZ says: “Sales figures for the 3-month period ending April 2021 are back from the previous 3-month period and are also significantly lower than the equivalent periods in recent years.

The lower sales volumes are following a lower than usual number of listings of farms for sale during Summer and early autumn. However the recorded sales are still at strong levels and comparable to 12 months earlier particularly for well developed farm properties. The recent land grab for forestry seems to have slowed in most areas. Buyer demand is still being noted in the horticultural and viticultural areas with recent events in Hawkes Bay possibly impacting buyer decisions in the short to medium term.

Buyers are very mindful of market conditions as we head into an election year. The gloomy outlook for farm product prices this season and inflation affecting farm operating costs are squeezing profitability margins and debt servicing ability for farmers. While buyers are still present in all markets, they are being very considered in their buying decisions.

In February 2023, Grazing farms accounted for a 32% share of all sales. Dairy farms accounted for 24% of all sales, finishing farms accounted for 24% of all sales and Dairy Support farms accounted for 7% of all sales. These four property types accounted for 87% of all sales during the three months ended February 2023.

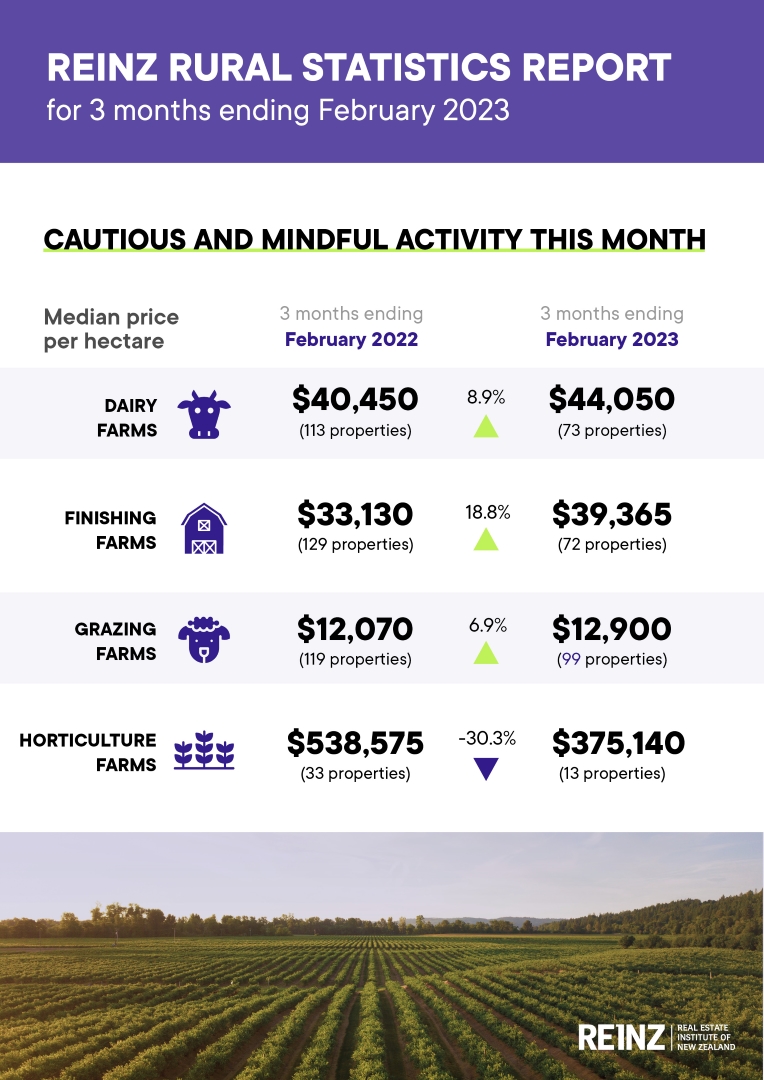

Dairy Farms

For the three months ended February 2023, the median sales price per hectare for dairy farms was $44,050 (73 properties), compared to $43,860 (83 properties) for the three months ended January 2023, and $40,450 (113 properties) for the three months ended February 2022. The median price per hectare for dairy farms has increased 8.9% over the past 12 months. The median dairy farm size for the three months ended February 2023 was 117 hectares.

On a price per kilo of milk solids basis the median sales price was $38.05 per kg of milk solids for the three months ended February 2023, compared to $40.26 per kg of milk solids for the three months ended January 2023 (-5.5%), and $32.63 per kg of milk solids for the three months ended February 2022 (+16.6%).

The REINZ Dairy Farm Price Index decreased 1.3% in the three months to February 2023 compared to the three months to January 2023. Compared to February 2022, the REINZ Dairy Farm Price Index increased 12.3%. The REINZ Dairy Farm Price Index adjusts for differences in farm size and location compared to the median price per hectare, which does not adjust for these factors.

Finishing Farms

For the three months ended February 2023, the median sale price per hectare for finishing farms was $39,365 (72 properties), compared to $39,355 (96 properties) for the three months ended January 2023, and $33,130 (129 properties) for the three months ended February 2022. The median price per hectare for finishing farms has increased 18.8% over the past 12 months. The median finishing farm size for the three months ended February 2023 was 40 hectares.

Grazing Farms

For the three months ended February 2023, the median sales price per hectare for grazing farms was $12,900 (99 properties), compared to $13,030 (101 properties) for the three months ended January 2023 and $12,070 (119 properties) for the three months ended February 2022. The median price per hectare for grazing farms has increased 6.9% over the past 12 months. The median grazing farm size for the three months ended February 2023 was 170 hectares.

Horticulture Farms

For the three months ended February 2023, the median sales price per hectare for horticulture farms was $375,140 (13 properties), compared to $375,140 (21 properties) for the three months ended January 2023 and $538,575 (33 properties) for the three months ended February 2022. The median price per hectare for horticulture farms has decreased -30.3% over the past 12 months. The median horticulture farm size for the three months ended February 2023 was 5170 hectares.